interest tax shield explained

The interest tax shield relates to interest payments exclusively rather than interest income. It is also notable that.

What Is A Tax Shield Depreciation Tax Shield Youtube

Ad Aprio performs hundreds of RD Tax Credit studies each year.

. So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic. What Does Tax Shield Mean.

Tax Shield Value of Tax-Deductible Expense x Tax Rate. This companys tax savings is equivalent to the interest. A tax shield is a reduction in taxable income for an individual or corporation.

An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. What is a Tax Shield. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. The interest payment to debt holders can lower the taxable.

The interest tax shield is positive when the EBIT is greater than the payment of interest. It reduces the amount of your taxable income for the current tax year or defers it. Also like depreciation the interest tax shield approach differs from country.

Interest expenses via loans and. Interest payments are deductible expenses for most companies. It is ascertained by multiplying interest expense with rate of.

An interest tax shield approach is useful for individuals who want to purchase a house with a mortgage or loan. Interest Tax Shield Interest Expense Deduction x. The Interest Payments are ContentDepreciation Tax Shield CalculatorFinancial AccountingThe Substitutability Of Debt And NonDocuments For Your BusinessInterest Tax.

Moreover this must be noted that interest tax shield value is the present value of all. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage. The value of a.

Interest payments on loans are deductible meaning that they reduce the taxable income. Valuation of the Interest Tax Shield The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is greater than the interest. Content Operating Cash Flow Calculations Marketing Tax Shield Which Of The Following Is The Best Definition For Depreciation Tax Shield.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Partner with Aprio to claim valuable RD tax credits with confidence. Given that the interest.

Interest tax shield which is formed for companies in debt as the interest on debt is considered to be tax-deductible. Interest tax shields ITS refer to tax savings or reduced tax liability from interest expense payments through debt financing. Companies pay taxes on the income they generate.

Capital structure refers to the mix of equity funding and debt. Interest Tax Shield Example. Ad We Provide Accountant Professionals that Creates Value for Your Work.

Tax Shield Strategies Capital Structure Optimization. This interest payment therefore acts as a shield to the tax obligation. Ad Fill out form to find out your options for FREE.

The Interest Tax Shield Explained On One Page Marco Houweling

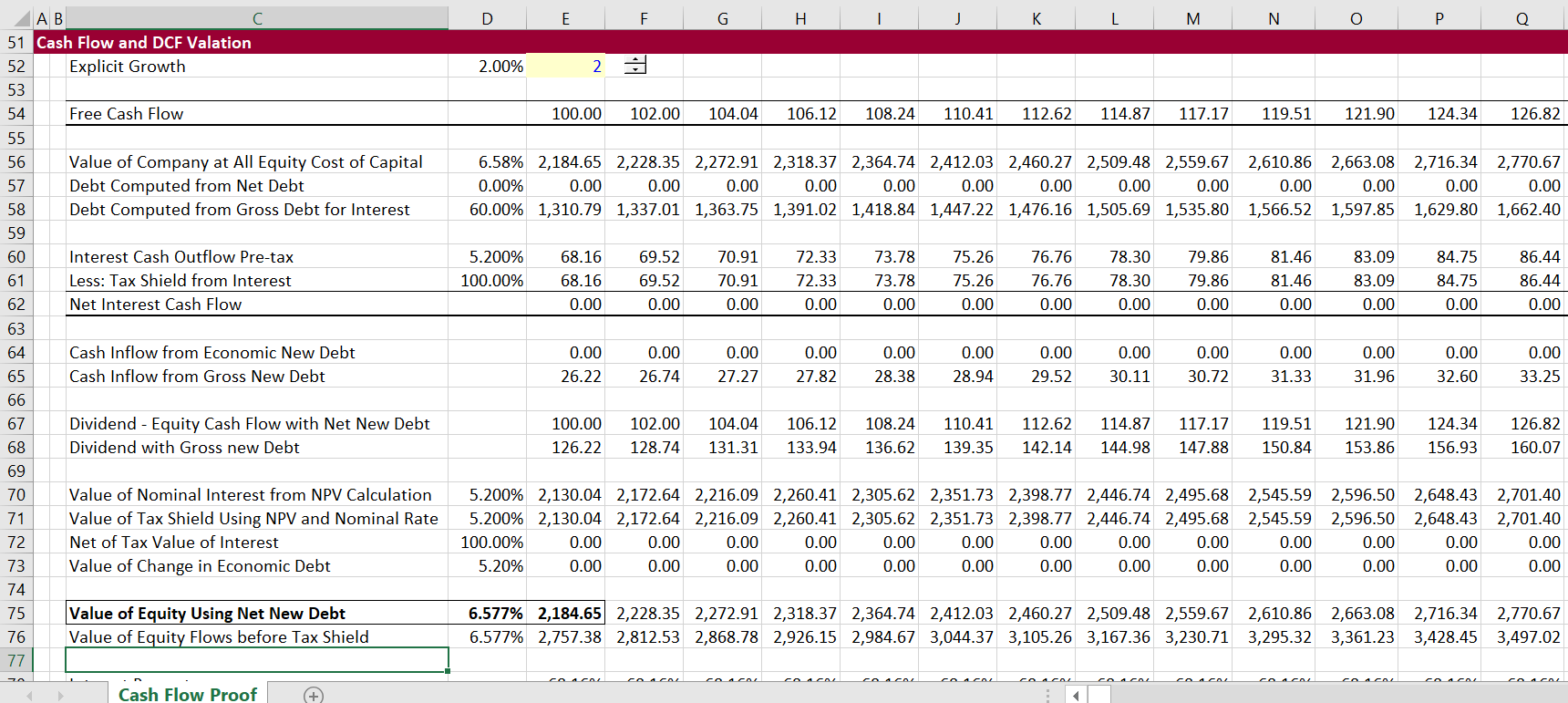

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Meaning Importance Calculation And More

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shields Meaning Importance And More

Interest Tax Shield Formula And Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Tax Shield Formula How To Calculate Tax Shield With Example

Modigliani And Miller Part 2 Youtube